MoneyBuckets

By Joseph Delgado. Copyright 2011 by Enchanted Quill Press LLC

Blog

11/16/11 -- Going Out to Eat

Going out to eat is one of the worst expenses for my family. It's easy to give up and feel bad that my wife is tired, that it's late, or we forgot to take something out to cook. We used to be worse when we first got married, but now following MoneyBuckets the money has to come from somewhere. That's the blessing of MoneyBuckets, if you have money set aside for Christmas, the Holidays, Vacation, or even Insurance. Once you have to dip into that bucket to cover your expenses...it becomes harder to accept. Taking money out means your getting off your plan and getting farther away from your goals.

I handle the money for my family and when I need to cover something that's unexpected or preventable like going out to eat. It bothers me, especially with one of our goals just eight months away. I'm often guilty of not policing myself with money and I'm often too hard on my wife. What's $0.99 for an app? $20 for a Kindle Book? Using my cash to buy lunch instead of brown bagging? So been doing my part to hit the mark also.

I feel it's important to have some "Overflow" money to do something you enjoy. I know the road is hard, so taking a break once in a while to celebrate the journey is important too. Give MoneyBuckets a try for your goals even if to setup a "going out to eat" bucket.

10/24/11 -- Backing Up MoneyBuckets Data

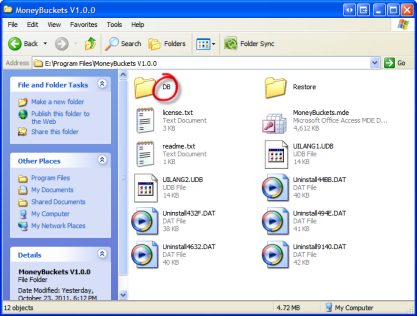

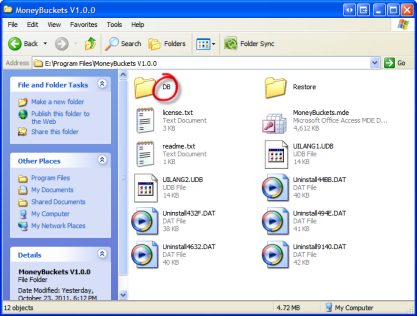

Finishing up the new version of MoneyBuckets (1.0.1) brought up my first real concern for our users. Protecting their data during an upgrade. So wanted to cover the quick way to backup your data. Using My Computer or Explorer go to where MoneyBuckets is installed typically C:\Program Files\MoneyBuckets V1.0.0 and under the DB directory copy MoneyBuckets_BE.mdb to another drive, USB stick, etc. If you can't find where MoneyBuckets is right click on the Desktop icon, choose properties, and look at the Target. Lastly you can find where the database is by clicking "About" in the Main Menu of MoneyBuckets.

Finishing up the new version of MoneyBuckets (1.0.1) brought up my first real concern for our users. Protecting their data during an upgrade. So wanted to cover the quick way to backup your data. Using My Computer or Explorer go to where MoneyBuckets is installed typically C:\Program Files\MoneyBuckets V1.0.0 and under the DB directory copy MoneyBuckets_BE.mdb to another drive, USB stick, etc. If you can't find where MoneyBuckets is right click on the Desktop icon, choose properties, and look at the Target. Lastly you can find where the database is by clicking "About" in the Main Menu of MoneyBuckets.

To restore the database just copy it back to that location and MoneyBuckets should start using it without any problems. Don't forget to backup your Budget Template as well. Most likely you have spent a long time working on the plan to have it lost. Be consistent with your backups, a backup from last year is better than nothing but still missing a lot of data.

10/12/11 -- Why MoneyBuckets?

Very proud to be writing this after a year and a half of part-time development on MoneyBuckets. I started writing MoneyBuckets after a commerical program stopped working after an update and refused to download my bank's transactions. It was one of those upgrade or else and I chose else. I started the average budget years ago on my Commodore 64 and some basic spreadsheet program. Keeping track of deposits and payments was very slow, but it worked for me. It worked when I was 16, working part-time, and living at my parents' house. As I got older, for some reason I stopped working my budget and got into debt.

When I got married the debt hole got deeper and my Dad bailed me out a few times, but still managed to get myself into trouble. A change in attitude had to occur if I was going to get anywhere. I was long overdue for some adult financial maturity. Reading Rich Dad/Poor Dad and playing Cash Flow 101 gave me a great respect for numbers, business, and investing. Still it didn't really help until I listened to Dave Ramsey's Total Money Maker Over as an audio book. Finally there were some steps to follow and we made some progress.

Am I debt free? Nope, not by a long shot. So I started with my spreadsheet budget again and found it too hard to keep track of everything in a spreadsheet. There were just too many checks, ATM visits, and Debit Card purchases to keep track of everything the way I used to. My commerical program was no longer an option and I wanted something that worked with my budget style. So created a few tables in Microsoft Access and started building MoneyBuckets from the ground up.

Finishing up the new version of MoneyBuckets (1.0.1) brought up my first real concern for our users. Protecting their data during an upgrade. So wanted to cover the quick way to backup your data. Using My Computer or Explorer go to where MoneyBuckets is installed typically C:\Program Files\MoneyBuckets V1.0.0 and under the DB directory copy MoneyBuckets_BE.mdb to another drive, USB stick, etc. If you can't find where MoneyBuckets is right click on the Desktop icon, choose properties, and look at the Target. Lastly you can find where the database is by clicking "About" in the Main Menu of MoneyBuckets.

Finishing up the new version of MoneyBuckets (1.0.1) brought up my first real concern for our users. Protecting their data during an upgrade. So wanted to cover the quick way to backup your data. Using My Computer or Explorer go to where MoneyBuckets is installed typically C:\Program Files\MoneyBuckets V1.0.0 and under the DB directory copy MoneyBuckets_BE.mdb to another drive, USB stick, etc. If you can't find where MoneyBuckets is right click on the Desktop icon, choose properties, and look at the Target. Lastly you can find where the database is by clicking "About" in the Main Menu of MoneyBuckets.